Reimagining trust and clarity in tax

remittance multiclient workflows

Designing the firm-side dashboard and mobile client app to

simplify payments, deadlines, and approvals

UI UX

B2B SAAS

Web and Mobile

Overview

Accounting firms often rely on fragmented tools to manage client tax remittances: spreadsheets, shared drives, emails, portals all stitched together by overworked teams under tight deadlines.

At Remitian (then Taxpay), a stealth-mode fintech startup, I was brought in to redesign the firm-side dashboard and help kickstart the client-facing mobile app. The goal was to simplify how accountants manage multiple clients’ payments, approvals, and upcoming tax deadlines, while also giving clients an easy way to track remittance status.

ROLE

Led the redesign, delivering structured flows, wireframes, and polished UI prototypes

COLLABORATORS

1 Designer, 1 Business Strategists, 1 Product Manager, 3 Developers,

TIMELINE

12 weeks | Nov 2024 - Feb 2025

IMPACT

30%

reduction in manual steps

25%

drop in missed deadlines

15%

increase in first task completion

The Problem

Filing was scheduled. Payments weren’t. That’s where we came in.

Accounting firms often rely on fragmented tools to manage client tax remittances: spreadsheets, shared drives, emails, portals all stitched together by overworked teams under tight deadlines.

At TaxPay, a stealth-mode fintech startup, I was brought in to redesign the firm side dashboard and help kickstart the client facing mobile app. The goal was to simplify how accountants manage multiple clients’ payments, approvals, and upcoming tax deadlines, while also giving clients an easy way to track remittance status.

Monthly, quarterly, annually across many accounts, accountants were juggling.

Manual

Tracking

No reminders

Document Storage

Version control

Approval Requests

Lost in inboxes

Submission Portals

No syncing of status

Client Communication

Manual follow-ups

BUSINESS VISION

Redesign experience & help firms build trust, save time, and grow faster

Reduce missed or delayed payments

Help firms protect client relationships and avoid costly interest or penalties

Simplify workflows to increase efficiency

Replace fragmented tools with dashboard for payments, deadlines, and approvals

Deliver a premium client experience

Give firms a competitive edge with proactive, full service tax management

MEET THE USER

Immersing myself in the day-to-day helped uncover what’s broken

Understanding the user began with shadowing workflows, mapping tool handoffs, and surfacing what slows them down the most. This helped me go beyond surface-level pain points and design with real priorities in mind.

CURRENT USER JOURNEY

By identifying and focusing on the user journey, I was able to identify the most pressing current concerns

This allowed me to understand the current infrastructure and ask questions about logic, design system components, and subsequently frame how potential solutions may fit into the current solution.

Key UX Considerations

User Research Insights led to the prioritization of key solutions that support all acountant functions and scale effectively

How might we

make it easier for accountants to confidently answer client questions with real-time information no guesswork, no follow ups?

Solution

The firm's dashboard experience reduces back and forth, bringing clarity and calm to even the busiest tax season

Approach

To reduce noise & elevate actionability, I focused on simplifying the dashboard experience through three core principles:

Prioritize Action

Approvals and tasks are surfaced first to drive focus

Declutter by Context

Only relevant, time-sensitive info is shown upfront

Align to Workflow

Grouped by how accountants actually work not just system logic.

1

DASHBOARD

Prioritizing Approvals Upfront

2

PAYMENTS

Smart Filters

Lets accountants narrow down by amount, status, and tax authority, instantly surfacing what matters

Actionable Payment Table

A clear, scannable layout highlighting due payments, statuses, and key details at a glance.

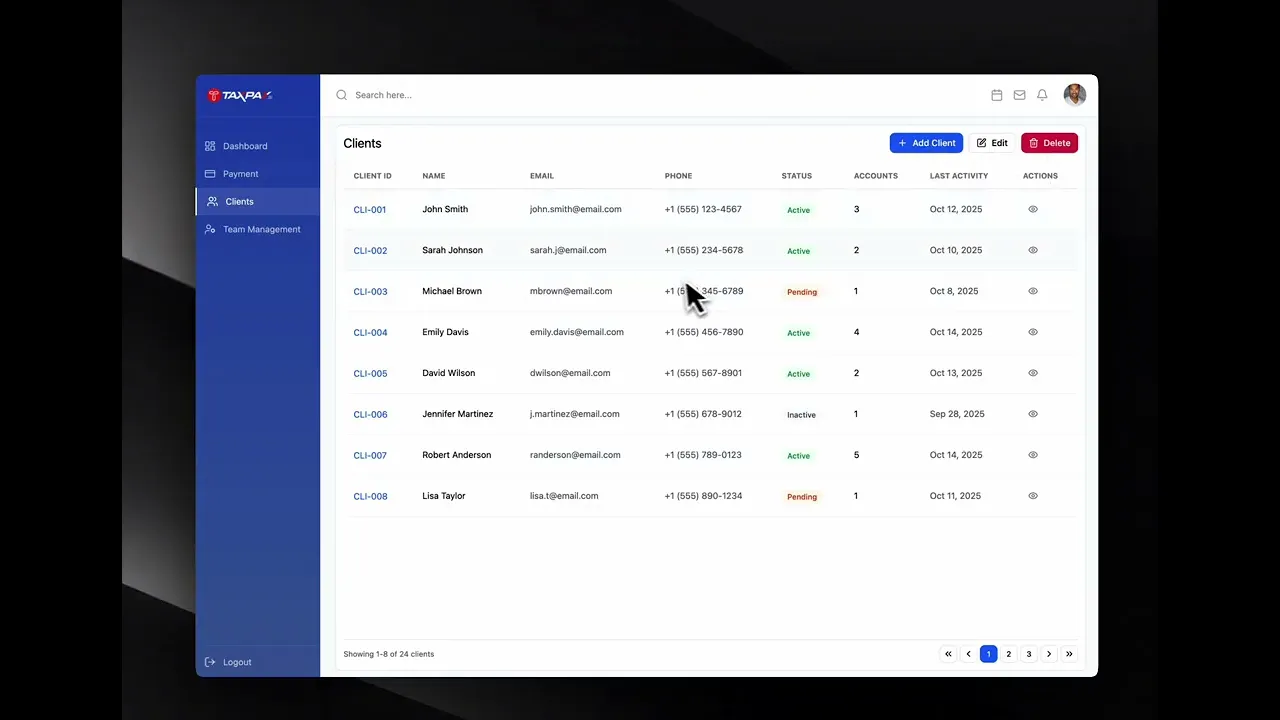

3

CLIENT MANAGEMENT

Prioritizing Approvals Upfront

Key approvals are surfaced right away with clear cards for Pending My Approval and Pending Client Approval. Below, a timeline view breaks down what needs attention now making it easy to act without digging.

Tax Form Review & Edits

Quickly view uploaded tax files and edit core business info or filing details. Add, update, or delete tax forms and payment entries all in one place.

4

FIRM EXPERIENCE

Experience the Full Product in Action

A complete walkthrough showcasing the Dashboard. From approvals to uploads, get a feel for how everything works together fast, seamless, and ready to use.

30%

reduction in manual steps

25%

drop in missed deadlines

15%

increase in first task completion

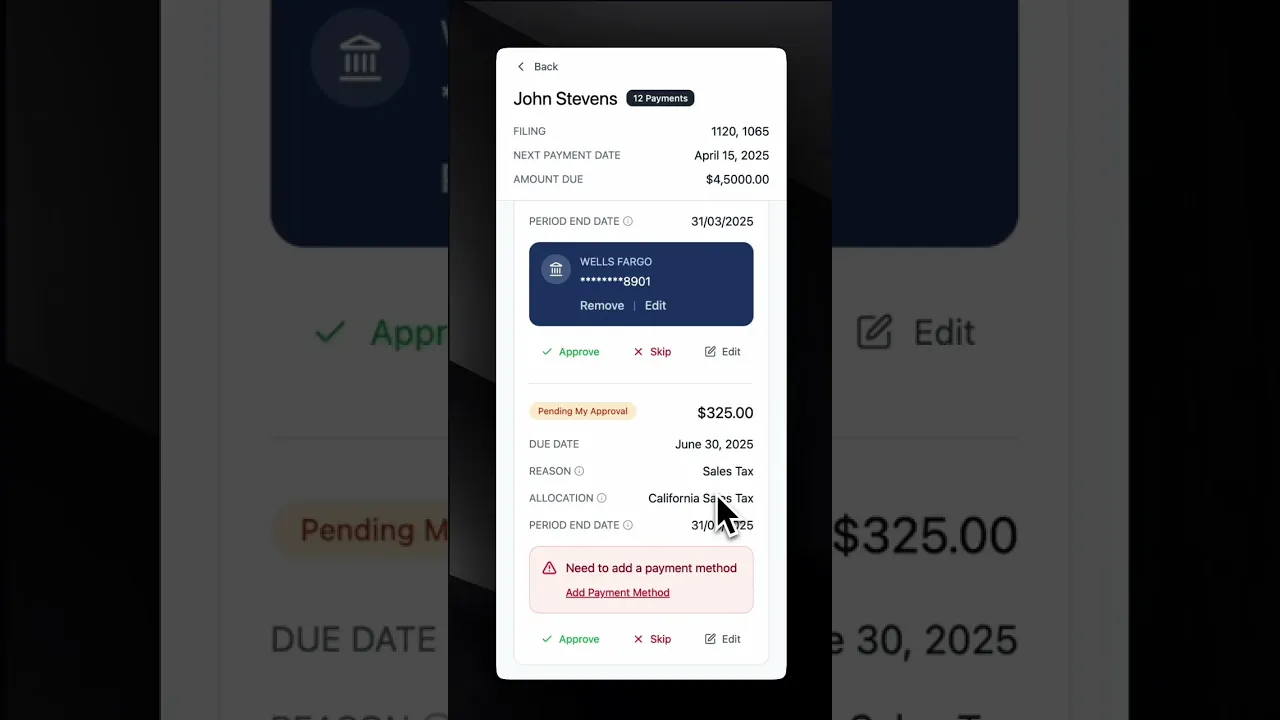

PHASE 2 - CLIENT EXPERIENCE

Clients shouldn’t have to chase down their own tax payments we gave them one place to handle it all

Approve, skip, or deny

payments in a single click with built-in context

Manage bank accounts

to control how and when payments are made

View payments by tax type

and account, making tracking and reconciliation intuitive

DESIGN SYSTEM

Learnings

What Startups Taught Me: Designing with Urgency, Tradeoffs & Trust

Comfort with chaos is a superpower, clarity is often a luxury

Startups don’t come with playbooks. I had to jump in, ask the right questions, and make confident calls even when direction was fuzzy. Instead of waiting for clarity, I learned to create it.

Business needs and user needs can pull in opposite directions

There were moments when what users wanted didn’t quite align with business constraints. I learned how to negotiate and prioritize, finding that middle ground where both could coexist.

This is just a part of the story…

Reach out for more on this project!